Introduction

Student loans have become a defining feature of modern higher education financing. In the United States alone, over 45 million borrowers collectively owe more than $1.7 trillion in student debt. While these loans open doors to academic and career opportunities, they often become financial burdens after graduation. One strategy many borrowers explore to ease this burden is student loan refinancing.

Refinancing can significantly lower interest rates, reduce monthly payments, and consolidate multiple loans into one manageable account. However, it’s not a one-size-fits-all solution. This comprehensive 3000-word guide dives deep into everything you need to know about student loan refinancing, including how it works, who it’s for, its benefits and drawbacks, and how to choose the right lender.

What Is Student Loan Refinancing?

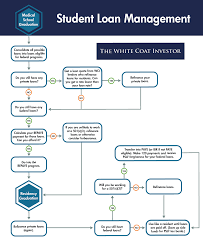

Student loan refinancing is the process of taking out a new loan from a private lender to pay off one or more existing student loans. The new loan typically comes with a lower interest rate, better repayment terms, or both. Borrowers can refinance federal loans, private loans, or a combination of the two.

Unlike federal loan consolidation, which is managed by the U.S. Department of Education and keeps the borrower within the federal system, refinancing is a private-sector solution. This distinction is critical when evaluating the risks and rewards.

How Does Student Loan Refinancing Work?

Here’s a simplified breakdown of how refinancing works:

-

Evaluate Your Current Loans

Determine the total balance, interest rates, and monthly payments of your existing loans. -

Check Your Credit Profile

Lenders will assess your credit score, income, employment status, and debt-to-income ratio. -

Shop Around for Offers

Compare multiple lenders to find the best interest rate, repayment terms, and borrower benefits. -

Apply for Refinancing

Submit documentation such as income verification, loan statements, and identification. -

Choose Your Terms

Select your repayment term—shorter terms offer faster payoff with less interest, while longer terms lower monthly payments. -

Sign the Agreement

Once approved, you’ll sign a new loan agreement. -

Old Loans Are Paid Off

The lender will use the new loan funds to pay off your existing loans. -

Start Repaying the New Loan

You now owe the new lender under the agreed-upon terms.

Benefits of Refinancing Student Loans

1. Lower Interest Rates

Perhaps the biggest advantage of refinancing is securing a lower interest rate than your original loans. Borrowers with strong credit or stable income could see their rates drop from 7-8% to as low as 3-5%.

2. Lower Monthly Payments

With reduced interest or extended repayment terms, refinancing can lower your monthly financial burden, freeing up cash flow for other expenses or investments.

3. Simplified Finances

Refinancing can consolidate multiple loans into one, meaning you only have one monthly payment, one due date, and one lender to deal with.

4. Customizable Repayment Terms

Most refinancing lenders offer terms ranging from 5 to 20 years, giving you flexibility to pay down debt faster or spread it out over time.

5. Release of Cosigner

Some refinance programs allow you to remove a cosigner from your original loan, relieving them of responsibility.

Drawbacks and Risks of Refinancing

1. Loss of Federal Loan Benefits

Refinancing federal student loans with a private lender means losing access to:

-

Income-Driven Repayment Plans

-

Public Service Loan Forgiveness (PSLF)

-

Federal Deferment or Forbearance

-

Loan Discharge Protections (e.g., death or disability)

2. Credit and Income Requirements

Private lenders require a good to excellent credit score (usually 650+) and stable income. Borrowers without these may need a cosigner or may not qualify.

3. Variable Interest Rate Risk

While variable rates may start lower than fixed rates, they can increase over time, possibly leading to higher payments in the future.

4. Hard Credit Pull

Most lenders perform a hard credit check during the application process, which may impact your credit score temporarily.

Who Should Refinance Student Loans?

Refinancing is not for everyone, but it can be highly beneficial for:

Borrowers with High-Interest Private Loans

If you have private loans with interest rates over 6%, refinancing can lead to substantial savings.

Borrowers with Stable Income and Good Credit

Refinancing rewards financial stability. The better your credit profile, the more favorable the terms.

Those Not Relying on Federal Benefits

If you’re not pursuing PSLF or income-driven repayment, refinancing may be advantageous.

Borrowers Seeking Simplified Repayment

Combining multiple loans into one monthly payment can reduce stress and streamline financial planning.

Who Should NOT Refinance Student Loans?

Borrowers Pursuing Loan Forgiveness

If you work in public service or qualify for any federal forgiveness programs, refinancing could disqualify you.

Those With Unstable Income

Federal repayment programs provide a safety net for borrowers whose income fluctuates. Private lenders do not offer similar flexibility.

Borrowers with Poor Credit

If your credit score is below 650, you may not qualify or may receive unfavorable interest rates.

Recent Graduates Without a Job

Refinancing typically requires at least several months of full-time employment and income verification.

Top Lenders Offering Student Loan Refinance (as of 2025)

| Lender | Fixed Rates | Variable Rates | Minimum Credit Score | Highlights |

|---|---|---|---|---|

| SoFi | 4.99% – 8.24% | 5.14% – 8.89% | 680 | Unemployment protection, member rewards |

| Earnest | 4.79% – 8.09% | 5.34% – 9.14% | 650 | Customizable payment terms |

| Laurel Road | 4.74% – 8.25% | 5.39% – 8.94% | 660 | Medical professionals get special rates |

| Credible (Marketplace) | Varies | Varies | 650+ | Compare multiple lenders at once |

| Education Loan Finance (ELFI) | 4.79% – 8.35% | 5.29% – 8.99% | 680 | High customer satisfaction |

Rates are for illustrative purposes and may change over time. Always check the lender’s official site.

How Much Can You Save by Refinancing?

Example Case Study

-

Original Loan Balance: $50,000

-

Original Interest Rate: 7.5%

-

Monthly Payment (10 years): $593

-

Total Interest Paid: ~$21,000

After refinancing:

-

New Interest Rate: 4.5%

-

New Monthly Payment (10 years): $518

-

Total Interest Paid: ~$12,200

-

Total Savings: ~$8,800

Steps to Refinance Student Loans

1. Assess Your Financial Position

Know your credit score, income, and loan details. Use loan calculators to estimate savings.

2. Research and Compare Lenders

Check interest rates, fees, benefits, repayment terms, and customer service reviews.

3. Prequalify

Many lenders offer soft credit checks that won’t affect your score. Use these to estimate your potential rates.

4. Prepare Documents

Have your personal ID, recent pay stubs, tax returns, and current loan information ready.

5. Apply Online

Most applications take less than 30 minutes. You’ll receive a decision within days.

6. Review and Sign

If approved, review the final terms. Once signed, your new lender pays off the old loans.

7. Begin New Payments

Ensure you understand your new payment schedule and set up autopay if offered (many lenders give a discount).

Student Loan Refinance vs. Federal Consolidation

| Feature | Refinancing | Consolidation |

|---|---|---|

| Type of Lender | Private | Federal |

| Eligibility | Private + Federal | Federal Only |

| Interest Rate | Credit-based | Weighted average |

| Loan Forgiveness Eligibility | No | Yes (e.g., PSLF) |

| Custom Terms | Yes | No |

| Risk | Loss of federal protections | Maintains protections |

Tips for Maximizing Refinance Success

-

Improve Your Credit Score

Pay off credit cards, avoid missed payments, and reduce debt-to-income ratio. -

Add a Cosigner

If your credit is average, a cosigner with strong credit can improve your approval odds. -

Shorten Your Loan Term

While it increases monthly payments, it significantly reduces total interest paid. -

Negotiate Terms

Some lenders may be willing to improve your offer if you mention a competitor’s better rate. -

Beware of Fees

Look out for origination fees, prepayment penalties, or hidden charges.

Tax Considerations

Student loan interest—up to $2,500 per year—may be tax-deductible. However, if you refinance and increase your income, you might become ineligible for the deduction due to income caps (around $90,000 for single filers, $180,000 for joint filers in 2025).

Consult a tax professional to understand how refinancing affects your deductions.

The Future of Student Loan Refinancing

AI-Powered Underwriting

Lenders are leveraging machine learning to assess creditworthiness more dynamically.

Income-Linked Loans

Future refinancing models may include income-sharing agreements or dynamic interest rates based on earnings.

Cryptocurrency Incentives

Some fintech lenders are experimenting with crypto rewards or blockchain-powered loan servicing platforms.

Policy Shifts

Government forgiveness programs and interest freezes may affect how attractive refinancing becomes.

Conclusion

Student loan refinancing offers a valuable path toward financial freedom, but it’s a decision that requires careful thought. It can lower interest rates, reduce payments, and streamline repayment, but it also comes with trade-offs—especially the loss of federal protections.

The right refinancing strategy depends on your financial health, loan type, career path, and long-term goals. Before taking the plunge, explore all options, consult financial advisors, and use calculators to weigh the pros and cons.

In a world increasingly burdened by education debt, refinancing is one of the smartest tools borrowers can leverage—when used wisely.