Starting with independent car insurance quotes, this paragraph aims to provide a compelling overview of the topic, highlighting the advantages of seeking quotes from independent sources, comparing them with traditional insurance companies, and offering tips for effective evaluation.

What are Independent Car Insurance Quotes?

Independent car insurance quotes refer to quotes provided by insurance brokers or comparison websites that are not affiliated with any specific insurance company. These quotes offer a comprehensive overview of available insurance options from various insurers, allowing consumers to compare prices, coverage, and benefits before making a decision.

Benefits of Obtaining Independent Car Insurance Quotes

- Access to a wide range of insurance options from different providers.

- Ability to compare prices and coverage to find the best deal.

- Objective advice and recommendations based on individual needs and preferences.

How to Obtain Independent Car Insurance Quotes?

To obtain independent car insurance quotes, follow these steps:

- Research reputable insurance comparison websites or independent brokers.

- Provide accurate information about your vehicle, driving history, and coverage needs.

- Receive quotes from multiple insurers and compare prices, coverage options, and customer reviews.

- Select the best insurance policy that meets your requirements and budget.

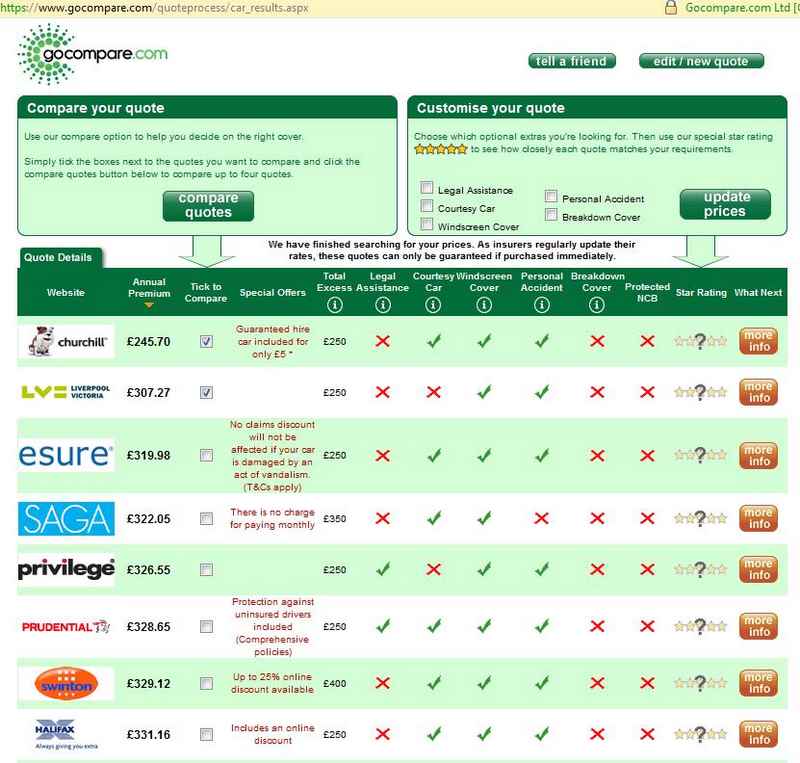

Online Platforms for Independent Car Insurance Quotes

There are several online platforms where you can get independent car insurance quotes, such as:

- Insurance comparison websites like Compare.com, Gabi, and The Zebra.

- Independent insurance brokers who work with multiple insurance companies.

- Insurance apps that allow you to compare quotes and purchase policies online.

Factors to Consider When Comparing Independent Car Insurance Quotes

When comparing independent car insurance quotes, consider the following factors:

- Coverage limits and deductibles offered by each insurer.

- Additional features like roadside assistance, rental car coverage, and gap insurance.

- The reputation and financial stability of the insurance company.

Importance of Coverage Limits and Deductibles, Independent car insurance quotes

Coverage limits and deductibles play a crucial role in determining the cost and extent of coverage in your insurance policy. It is essential to choose limits that adequately protect your assets and liabilities in case of an accident.

Benefits of Choosing Independent Car Insurance Quotes

Opting for independent car insurance quotes comes with several advantages, including:

- Customized coverage options tailored to your specific needs.

- Potential cost savings compared to traditional insurance companies.

- Transparent pricing and unbiased advice from independent sources.

Concluding Remarks

In conclusion, independent car insurance quotes present a tailored and cost-effective option for individuals seeking comprehensive coverage. By understanding the key factors and benefits, you can make an informed decision when choosing your insurance provider.

FAQs

What are Independent Car Insurance Quotes?

Independent car insurance quotes are quotes obtained from non-affiliated sources, offering unique benefits and tailored coverage options.

How to Obtain Independent Car Insurance Quotes?

To get independent car insurance quotes, you can utilize online platforms, websites, or contact independent insurance agents for personalized quotes.

Factors to Consider When Comparing Independent Car Insurance Quotes

Key factors to consider include coverage limits, deductibles, additional features, insurer reputation, and financial stability for a comprehensive evaluation.

Benefits of Choosing Independent Car Insurance Quotes

Choosing independent quotes can offer tailored coverage options, potential cost savings, and flexibility compared to traditional insurers.